The Perfect Put Option Selling Program For Beginners

We hand pick every option and deliver them straight to your inbox.

Having followed you now for a while, I have come to trust your recommendations. It all becomes a question of trust in your expertise for picking trades - which I've come to rely on. So I consider you like a private analyst, and I just want the best trades that fit my margin requirements to maximize my income.

Dhavid Cooper

How Does Steady Option Income Subscription Work?

You'll Get An Email With The Latest Options Once Per Week

The subscription teaches two objectives:

First Trade – Cover subscription cost.

Second Trade – Generate a profit.

Each trade is one contract.

Save Time By Letting Us Do All Of The Work!

As a put option seller, it’s time consuming to find quality stocks with high premium. Not only do you need to search for quality stocks, but then you have to ensure they also have a great return on premium. With Steady Option Income, you no longer have to spend mountains of your time in this very tedious task.

Two Trades Per Month!

Pays for your subscription

With only two trades per month, one to cover the subscription cost and the other to generate profit, you avoid overtrading.

Two trades per month keep things very simple and manageable for beginners. While there is often one trade issued per week, we want beginners to stick with the plan of only two trades per month. After showing consistency, more trades can be added.

Overtrading is the downfall of many options traders. After a few weeks of consistent profit, a trader falls into the trap of adding more contracts and taking on more exposure. The market has a funny way of knowing this and will catch you off guard at the worst moment.

Monthly results are based on sizing metrics (i.e., 1-3 contracts) for each alert with a profit target 0.10.

2024 Performance

1/1/2024 - 2/29/2024: 100% of trades (8 fo 11) have been opened and closed for profit.

Jan: $1060

Feb: $450

Mar: $-

Apr: $-

May: $-

Jun: $-

Jul: $-

Aug: $-

Sep: $-

Oct: $-

Nov: $-

Dec: $-

2023 Performance

1/1/2023 - 11/30/2023: 100% of trades (23 fo 23) have been opened and closed for profit.

Jan: $438

Feb: $353

Mar: $335

Apr: $105

May: $0

Jun: $0

Jul: $0

Aug: $360

Sep: $155

Oct: $70

Nov: $425

Dec: $-

2022 Performance

1/1/2022 - 12/30/2022: 90.24% of trades (37 of 41) have been opened and closed for profit.

1 trade was assigned (2.44%).

1 trade closed for a loss (-$20/contract) (2.44%).

2 trades remain open from Dec (4.88%).

Jan: $280

Feb: $270

Mar: $320

Apr: $605

May: $53

Jun: $65

Jul: $345

Aug: $465

Sep: $150

Oct: $145

Nov: $320

Dec: $90

2021 Performance

1/1/2021 - 12/31/2021: 97.78% of trades (44 of 45) have been opened and closed for profit.

1 trade was assigned and is still open.

Jan: $395

Feb: $305

Mar: $303

Apr: $380

May: $220

Jun: $335

Jul: $392

Aug: $80

Sep: $428

Oct: $272

Nov: $180

Dec: $320

2020 Performance

1/1/2020 - 12/31/2020: 100% of trades (42) have been opened and closed for profit.

41 trades hit our profit target and 1 was scratched for less profit.

Jan: $265

Feb: $245

Mar: $190

Apr: $245

May: $190

Jun: $370

Jul: $290

Aug: $200

Sep: $305

Oct: $345

Nov: $260

Dec: $450

2019 Performance

1/1/2019 - 12/31/2019: Out of 51 trades opened and closed, 47 hit our profit target.

3 were scratched for profit for

100% of trades closed profitably.

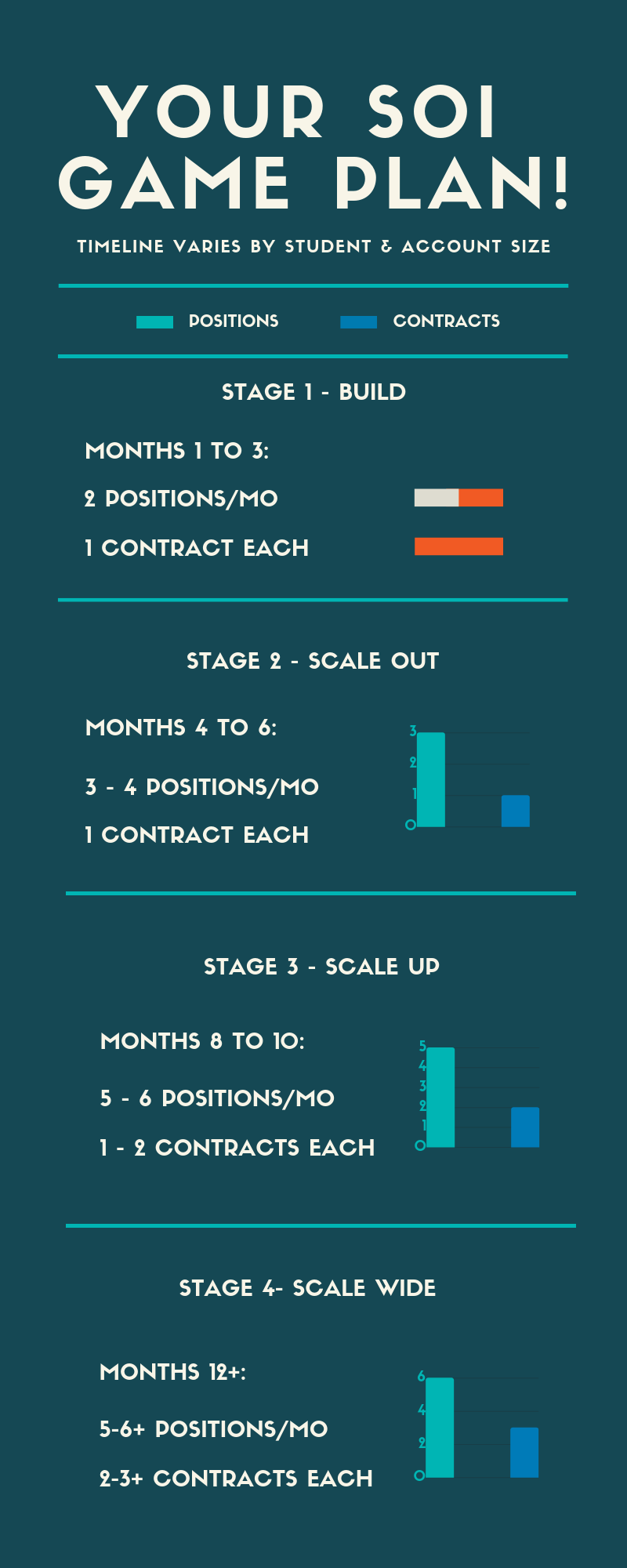

...Then Learn How To Scale

4 Stages. 12 Months.

Stage 1 - Build. Learn the mechanics of entering and exiting put selling trades. Be aware of exit points. Build into consistent opening and closing of trades.

Stage 2 - Scale Out. Slowly add more positions. Learn to manage a larger portfolio.

Stage 3 - Scale Up. Begin to learn sizing by adding one more contract and slowly adding another position. Learn to manage a larger portfolio with more complexity.

Stage 4 - Scale Wide. A continuation of Stage 3 with more positions and contracts. With some positions holding 3 contracts, learn more flexible sizing (small, normal, large). Continue perfecting system by staying with current number of positions and contracts.

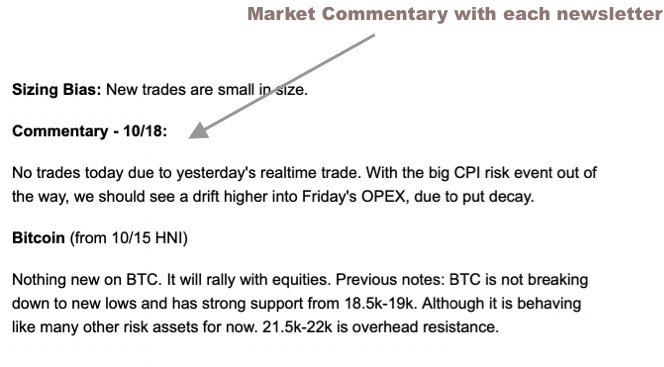

Reduce Your Risk With Far Out Of The Money Puts

A unique feature of the SOI Newsletter is that we only trade far out of the money puts. Why? Risk reduction. There’s a greater chance of our puts expiring worthless than if we choose a strike much closer to the stock price.

Doesn’t far out of the money puts have lower premiums? That’s the general consensus but we are able to find puts that have at least a ~20% annualized return and often higher. This is how our newsletter is able to generate a steady monthly income without the stress and additional management of having options put to you.

Risk Off!

We spend hours identifying and removing risks for each option in the newsletter. We also go far out of the money, which means less chance any stock will fall below our option strike....

...but being far out of the money doesn't mean we sacrifice return!

Downside Risk Management

(Included In The Program)

Downside risk management is essential to put option selling. You'll learn several techniques for reducing downside exposure.

Got Questions?

You can contact us here.

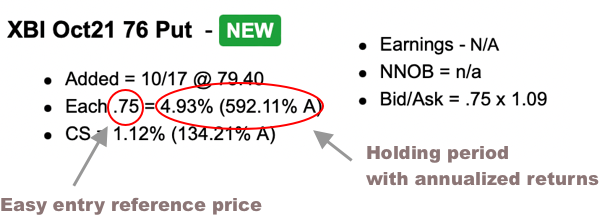

Here's What You'll Find In Each Email

Cash Secured Puts Welcomed

SOI Basic put options generally top out around a 250 strike. This makes them more viable for cash accounts and selling cash secured puts.

In the above trade screenshot, the "CS" value stands for cash secured returns and is included with every trade.

Want to see more?

Click here to watch the SOI newsletter tutorial for new members.

Your newsletter and service are excellent and don’t have 1 complaint...

Joe Skrocki

Cancel Anytime!

Simply reply to any newsletter mentioning you'd like to cancel.

I am very happy with my subscription. Of course I like your recommendations. There are not many newsletters, if any at all, that recommend put sells and if they do the premiums are too low or too close to in the money to take a chance on. I bought the 6 month subscription and made more than the price back on the first trade.

Barry Castleberry

Your price is really fair and the service is great.

Mark Weisman

Just One Trade From the List Can Pay For Your Monthly Subscription!

Frequently Asked Questions

How are alerts delivered?

Alerts are delivered through email to the email address you signed up with. You can switch to a different email by writing us through the contact form, replying to one of your welcome emails, or any newsletter.

How often are emails sent out?

Once per week. However, not every email will have an opportunity. It depends on market conditions.

How many days do I get with each paid period?

Your subscription is monthly or to be precise, every 30 days.

Do you offer options on ETFs and commodities?

No — the returns simply aren't there.

Will I learn how to protect downside risk?

Yes. You'll learn about several techniques for protecting downside risk.

Can I cancel my subscription at anytime?

When I cancel the service, do I get a refund for the unused period?

Refunds aren't given for unused periods but you will continue to have access until the end of your paid period. Once you cancel, you'll no longer be charged and your subscription will end once your paid period expires. Note that if you want to cancel, do so a few days before your auto-bill for the next period.

Do I need to follow the timeline exactly?

No. Some traders will go more slowly. The timeline is a guide broken down into stages. However, student shouldn't try to increase their pace against the timeline. This shows overconfidence and and lack of discipline.

What is the price range of stocks you sell puts on?

Most are $100-$200 and periodically $200-$300.

The ONLY 100% dedicated Put Option Writing newsletter! |